Silicon carbide has properties that could make it indispensable for the next generation of battery-powered vehicles. By Will Girling

Although the global electric vehicle (EV) market has grown rapidly in recent years, the underlying technology is still far from perfect for OEMs seeking mass market success. Crucially, the overall powertrain must become more efficient while new battery solutions are developed in tandem to resolve common customer pain points like range anxiety.

Silicon carbide (SiC) devices could prove essential for keeping automakers on track. The long-term value of SiC in the context of electrification is clear: worth US$4.2bn in 2024, the total market is expected to reach US$17.2bn by the end of the decade (+310%), according to Precedence Research. But what are the benefits and applications of SiC today, and why is its future intrinsically linked to e-mobility?

SiC’s impact on the electric powertrain

SiC metal–oxide–semiconductor field-effect transistors (MOSFETs) are gradually replacing previous generation silicon insulated-gate bipolar transistors (IGBTs) in EV electronics. According to Riccardo Nicoloso, General Manager of the New Material Division at STMicroelectronics (ST), substituting these components can unlock a multitude of powertrain benefits. “You cannot go to the next level of battery EV development without SiC,” he states. Specific enhancements include improved conductivity, higher voltage architectures, reduced cabling and more concise electronic layouts.

This combination of properties can significantly improve key aspects of the electric powertrain. For example Akifumi Enomoto, Department Manager of Power Devices Business Strategy Department at Rohm Semiconductor, tells Automotive World that SiC devices in any type of EV can help improve traction inverter efficiency. Since this component converts DC energy from the battery into AC to drive the vehicle’s motor, any functionality boost could improve previous range specs.

Enomoto notes that transistors in EVs with an 800V battery system—an emerging trend, with current examples including the Porsche Taycan and Audi e-tron GT—must be able to safely withstand up to 1,200V. SiC MOSFETs possess both higher conductivity and switching speeds than silicon IGBTs. As such, the former have 3-8% higher efficiency than the latter in a traction inverter. “That means it is possible to extend the driving range with the same battery capacity, or even reduce the size of the battery capacity for the same driving range,” he explains.

Similarly, Nicoloso believes SiC could help reduce battery sizes 10% without any consequent power loss. In fact, increased conductivity and reduced system power loss could both boost EV motor output and shorten average EV charge times from 16 minutes to seven, as SiC maintains a more optimal temperature at high voltages than regular silicon.

Responding to the market

Recognition of SiC’s potential in automotive has caused R&D to accelerate. In June 2024, ST signed a long-term SiC MOSFETs supply agreement with Geely for inclusion across a variety of its “mid-to-high-end” EV brands. Nicoloso confirms that his company’s components are already present in some models but does not provide specifics. The agreement’s foundation is primarily based on SiC’s positive impact on traction inverters, although he hints that this is just the tip of the iceberg.

A joint innovation lab will help Geely and ST explore developments in connected and electric mobility to build mutual understanding about SiC’s future role. “From our side, it’s great to learn what OEMs and customers want from vehicle performance,” says Nicoloso. “It’s important that we’re always following trends, particularly the introduction of new models.” ST will also provide SiC devices for DC-DC converters, onboard chargers, and e-compressors. He adds that higher, SiC-driven system efficiency could be integral for EVs incorporating autonomous functionality, as these systems are notoriously power hungry and inefficient.

Enomoto agrees that swiftly responding to market changes and demands is essential: Rohm is prioritising the iteration of its SiC MOSFETs, targeting reduced conductivity and switching loss. Development of the company’s sixth and seventh generation products for 2027 and 2029 respectively are already underway, “one year ahead of our original plan.”

Rohm’s latest (fourth generation) SiC transistors lower on-resistance—the measurement for current’s difficulty in flowing between drain and source terminals—by 40% and switching loss by 50% compared to the previous generation. Crucially, this is achieved without any performance trade-offs, and the company is already mass producing them for inclusion in “numerous” vehicles. In the near term, its fifth generation SiC MOSFETs—scheduled for release in 2025—are set to reduce on-resistance at high operating temperatures by 30% more than the fourth generation.

Expanding capacity

An October 2023 report by McKinsey & Co concluded that SiC represents a significant opportunity for competitive gains among automakers, yet the market’s value chain is “dynamic” with a “high degree of uncertainty”. Factors include evolving inverter designs, investment from non-traditional sources (i.e. OEMs), and new manufacturing techniques. So, how will the SiC market develop in the medium term?

The use of SiC devices and modules is also increasing in hybrids and plug-in hybrids

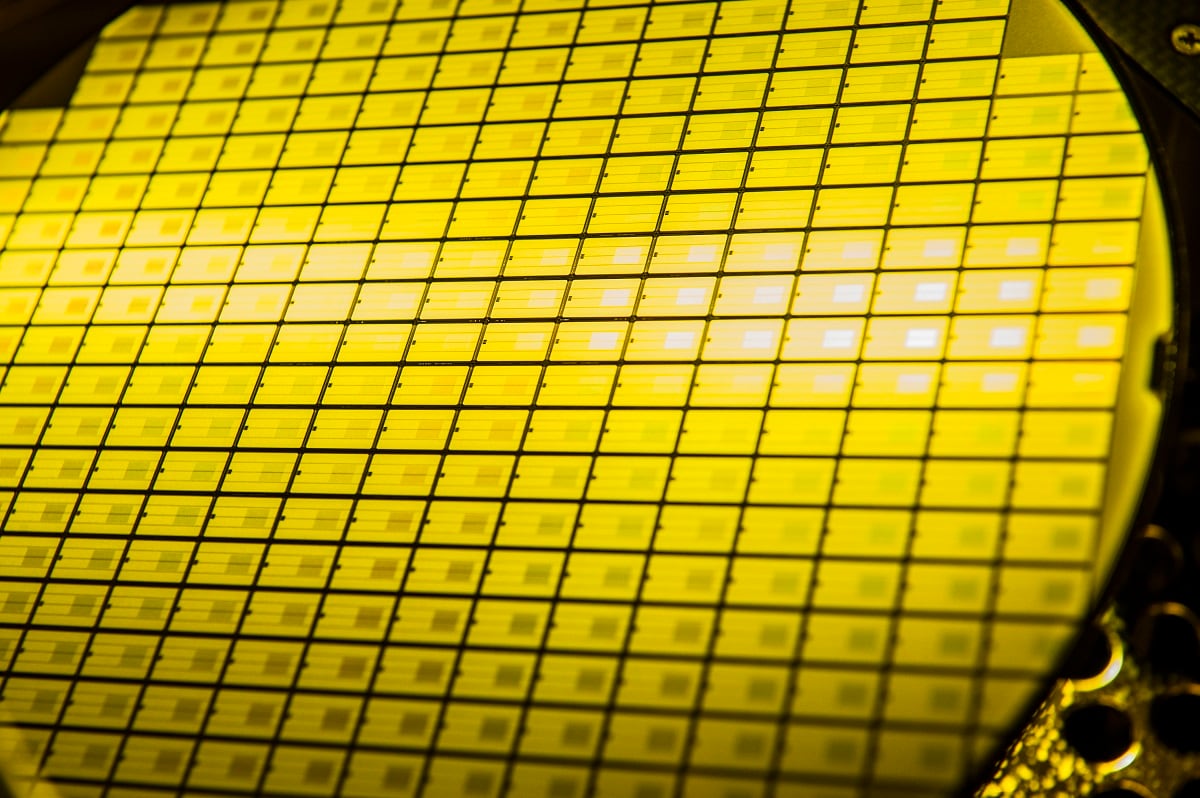

Both Nicoloso and Enomoto believe demand for the material will remain very strong—in fact, the latter suggests that suitably enlarging production capacity will be the main challenge going forward. He notes that the Japanese New Energy and Industrial Technology Development Organization (NEDO) Green Innovation Fund Project has adopted measures to improve the manufacturing processes of eight-inch (200mm) wafers necessary for creating next-gen SiC devices. To date, these wafers have generally been six inches, restricting the potential number of integrated circuits per device.

Capacity is also ticking up in Europe—in May 2024, ST announced that it plans to build “the world’s first fully integrated SiC facility” in Catania, Italy. The €5bn (US$5.4bn) site, called the Silicon Carbide Campus, aims to integrate all aspects of the SiC ecosystem: R&D, product design, substrate development, epitaxial (the deposit of silicon-based crystalline films) growth, 200mm wafer fabrication, and assembly. Production is scheduled to start in 2026, with full ramp-up (15,000 wafers per week) from 2033.

Enomoto observes that the SiC market is growing year-on-year and relatively inoculated from EV sales slowdowns in some regions: “In addition to electric cars, the use of SiC devices and modules is also increasing in hybrids and plug-in hybrids.” In the US, Morgan Stanley recorded that hybrid sales outpaced EVs five to one during February 2024. Indeed, Nicoloso is ebullient about SiC’s future in automotive: “Any vehicle with a battery will benefit.”